Announcement

Starting from the 1st of October 2021 the Royal Thai Embassy has introduced the following new requirements for the visa O-A application stated that the applicant must have a health insurance for the duration of stay, with coverage of at least 3 million baht. The new certificate will start after the date.

For renewal customers the coverage will need to change to at least 3 million baht, starting from 1st of September 2022.

Coverage with top Thai private hospital

No advance payment needed with our Thai Health Insurance’s Card, acceptable with more than 300 Network Hospitals throughout Thailand.

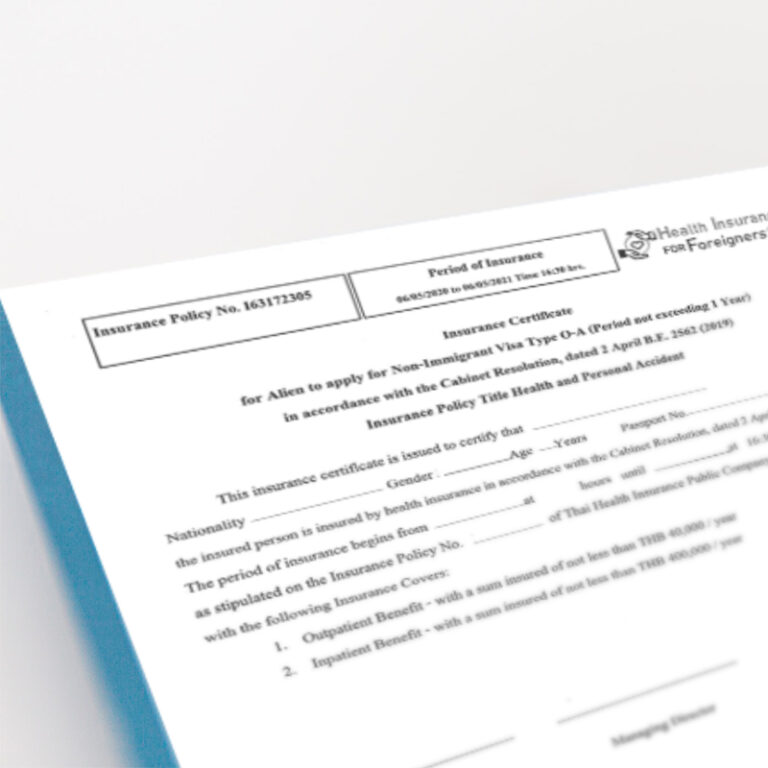

Certificate for VISA

To confirm your insurance, we issue Certificate which can be use to apply VISA type O-A, 1 year. Our Certificate has approved by regulator and acceptable with the Immigration Office.

Worldwide Coverage

Our coverage also include Worldwide coverage and Emergency Assistant by Allianz Global Assistance** (terms and conditions apply to Allianz Global Assistance)

If you are applying for O-A visa, please also send us an email, since the company will need to submit your policy to the immigration office to confirm your coverage.

| Inpatient Hospitalization (IPD) Coverage | EX 3M | EX 5M | EX 10M | ||||

|---|---|---|---|---|---|---|---|

| Maximum Benefit (Baht) | 3,450,000 | 5,600,000 | 10,900,000 | ||||

| Coverage | Coverage | Coverage | Coverage | ||||

| THB | THB | THB | |||||

| 1. Inpatient Hospitalization (IPD) coverage | 1,950,000 | 2,600,000 | 3,900,000 | ||||

| Section 1. Room and Board Cost, Hospital Fee (IPD) per An Inpatient Hospitalization for A Disability (Max. per Day, Limit 60 Days) | 15,000 | 20,000 | 30,000 | ||||

| In case the Insured hospitalizes in Intensive Care Inpatient Room (ICU), Room and Board, Hospitalize Expenses will be paid by 2 times of Benefit in Section 1. (Limit 15 days) | 30,000 | 40,000 | 60,000 | ||||

| Section 2. Medical Fee for Diagnosis or Treatment, Blood or Blood’s Components Cost, Nursing Care Fee, Medicine Cost, Parenteral Nutrition Cost, and Medical Supplies Cost per An Inpatient Hospitalization for A Disability | 150,000 | 200,000 | 300,000 | ||||

| Section 3. Physician Fee for Diagnosis per An Inpatient Hospitalization for A Disability (Max. per Day, Limit 60 Days) | 3,750 | 5,000 | 7,500 | ||||

| Section 4. Surgical Treatment and Medical Procedure Expenses per An Inpatient Hospitalization for A Disability | 225,000 | 300,000 | 450,000 | ||||

| Subsection 4.5. Surgical Treatment Expenses for Organ Transplant will be paid by 2 times of Benefit in Section 4. | 450,000 | 600,000 | 900,000 | ||||

| Section 5. Surgical Treatment Expenses for Major Surgery that not require Inpatient Hospitalization (Day Surgery) | include in Section 4 | include in Section 4 | include in Section 4 | ||||

| 2. Coverage in case of Not Require Inpatient Hospitalization | |||||||

| Section 6. Medical Fee for Diagnosis Directly Related to, Before and After Inpatient Hospitalization or Continuous OPD Treatment Directly Related to, After Inpatient Hospitalization per An Inpatient Hospitalization for A Disability | include in Section 2 | include in Section 2 | include in Section 2 | ||||

| Section 7. OPD Treatment Expenses for Injuring per Time, within 24 Hours after Accident | 30,000 | 40,000 | 60,000 | ||||

| Section 8. Rehabilitation Medicine after Each Inpatient Hospitalization per An Inpatient Hospitalization for A Disability | include in Section 2 | include in Section 2 | include in Section 2 | ||||

| Section 9. Medical Fee for Treatment of Chronic Kidney Failure by Kidney Dialysis per Policy Year | include in Section 2 | include in Section 2 | include in Section 2 | ||||

| Section 10. Medical Fee for Treatment of Tumor or Cancer by Radiation Therapy, Interventional Radiology, Nuclear Radiology per Policy Year | include in Section 2 | include in Section 2 | include in Section 2 | ||||

| Section 11. Medical Fee for Treatment of Cancer by Chemotherapy per Policy Year | include in Section 2 | include in Section 2 | include in Section 2 | ||||

| Section 12. Ambulance Fee (include in Section 2.) | 15,000 | 20,000 | 30,000 | ||||

| Section 13. Surgical Treatment Expenses for Minor Surgery | include in Section 4 | include in Section 4 | include in Section 4 | ||||

| Major Medical Coverage | |||||||

| Maximum payable per disability/time/year | 1,500,000 | 3,000,000 | 7,000,000 | ||||

| ( Pays 100 Percent of the Eligible Expenses in Excess of the Deductible ) | |||||||

| Deductible (pay by the Insured) | 150,000 | 200,000 | 300,000 | ||||

| Room and Board, Nursing Care (Max. per day, starts on 61st day) | not cover | not cover | not cover | ||||

| Personal Accident Coverage (PA 2) | |||||||

| Accidental Death, Dismemberment, and Total Permanent Disability | 200,000 | 200,000 | 200,000 | ||||

| (Murder or Assault, payable 100 percent of PA coverage) | |||||||

| (Drive Motorcycle or Passenger on Motorcycle, payable 100 percent of PA coverage) | |||||||

| Worldwide Emergency Assistant Coverage (By AWP Services (Thailand) Co. Ltd.) | |||||||

| Emergency Medical Evacuation | USD 1,000,000 | USD 1,000,000 | USD 1,000,000 | ||||

| Medical Repatriation | |||||||

| Repatriation of Mortal Remain | |||||||

| อายุ (ปี) / age (years) | 3M | 5M | 10M |

|---|---|---|---|

| 15 วัน/days – 5 yrs | 351,251 | 433,354 | 582,935 |

| 6-10 | 162,710 | 200,604 | 269,642 |

| 11-20 | 68,439 | 84,229 | 112,995 |

| 21-35 | 54,973 | 67,604 | 90,617 |

| 36-40 | 63,054 | 77,579 | 104,043 |

| 41-45 | 68,439 | 84,229 | 112,995 |

| 46-50 | 81,907 | 100,854 | 135,373 |

| 51-55 | 95,374 | 117,479 | 157,751 |

| 56-60 | 108,842 | 134,104 | 180,129 |

| 61-65 | 135,944 | 167,522 | 225,053 |

| 66-70 | 190,149 | 234,358 | 314,902 |

| 71-75* (ต่ออายุ / renew) | 271,624 | 334,780 | 449,843 |

| 76-80* (ต่ออายุ / renew) | 406,296 | 501,030 | 673,624 |